I see negative values in percentage terms for debt to equity ratio factor when i ran fundamentals back test. what does negative debt to equity mean? Is it ok to have negative debt to equity ratio stocks included in the. mix and will it have any unintended impact on the stock selection?

Thanks

4 Replies

Thanks. Is there a mechanism to filter these out? If not is it ok to include them?

Hi Harry,

We just checked and the reason is because the total stockholder equity for these companies are negative. This causes the debt to equity ratio to be negative. There could be many reasons why their equity is negative, such as suffering accumulated losses over several periods, large dividend payments that exhausted retained earnings, borrowing money to cover losses or amortization of intangible assets.

You can refer to this link on Investopedia for more information.

https://www.investopedia.com/ask/answers/08/negative-shareholder-equity.asp

Kind regards,

The PyInvesting Team

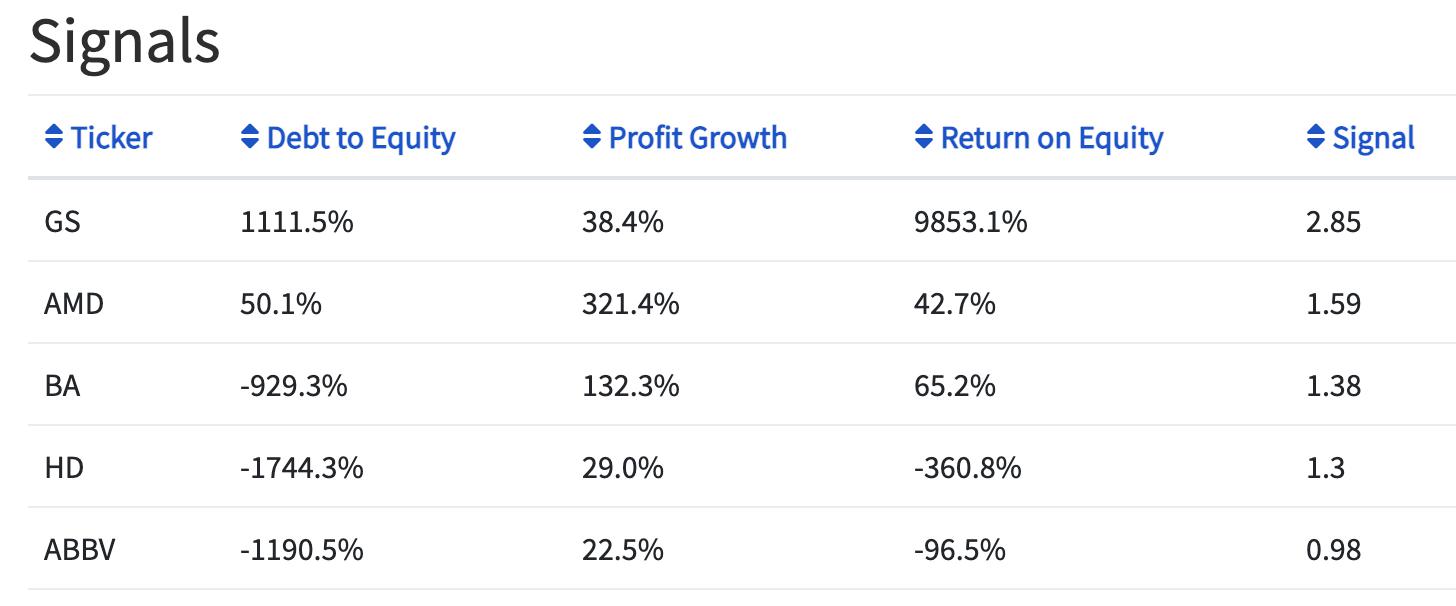

HD and ABBV - i see -1744% and -1190% in debt to equity column in signals section.

Hi Harry,

Can you please let us know the name of the stock with negative debt to equity ratio? Thank you.

Kind regards,

The PyInvesting Team

© PyInvesting 2025