60 - 40 Stock Bond Mix

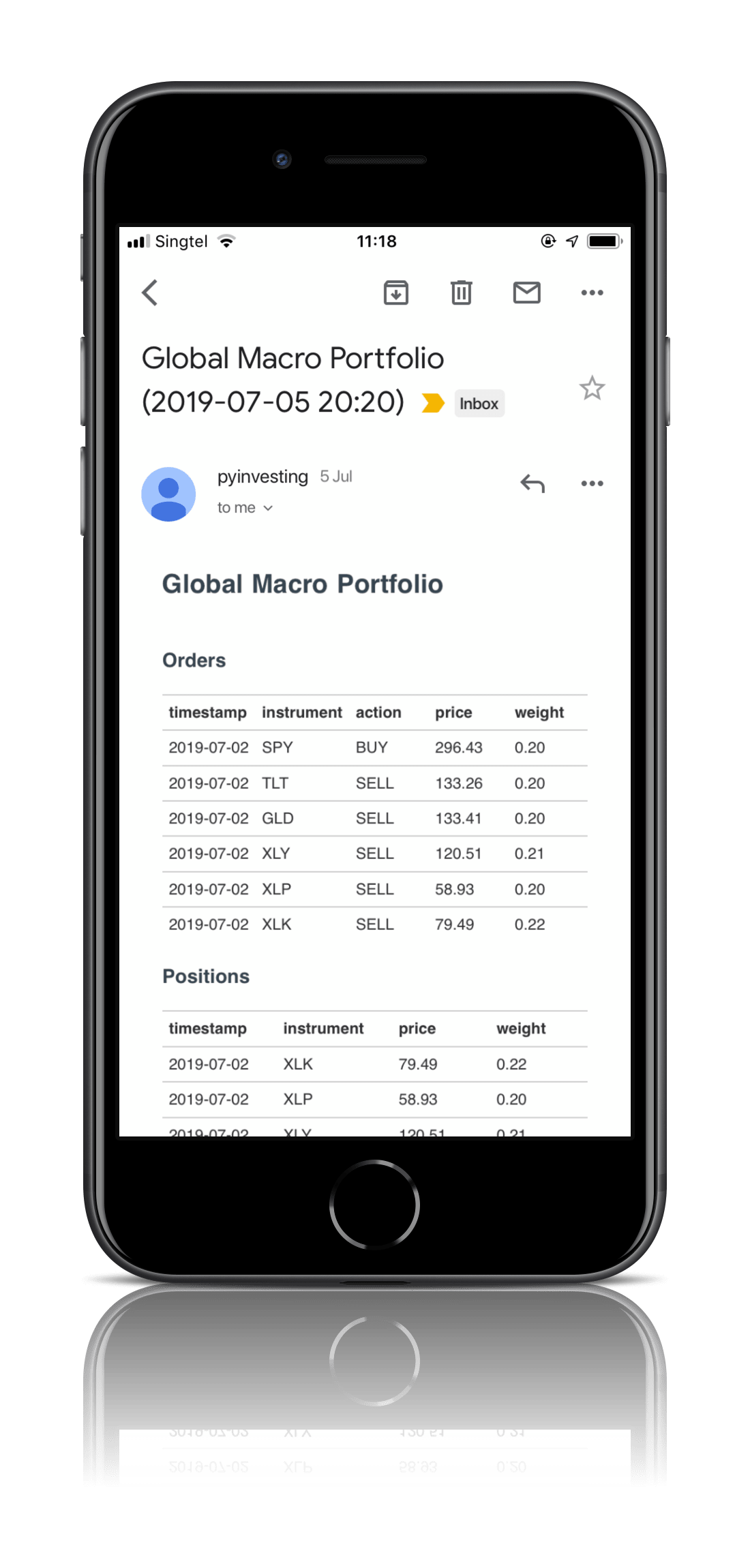

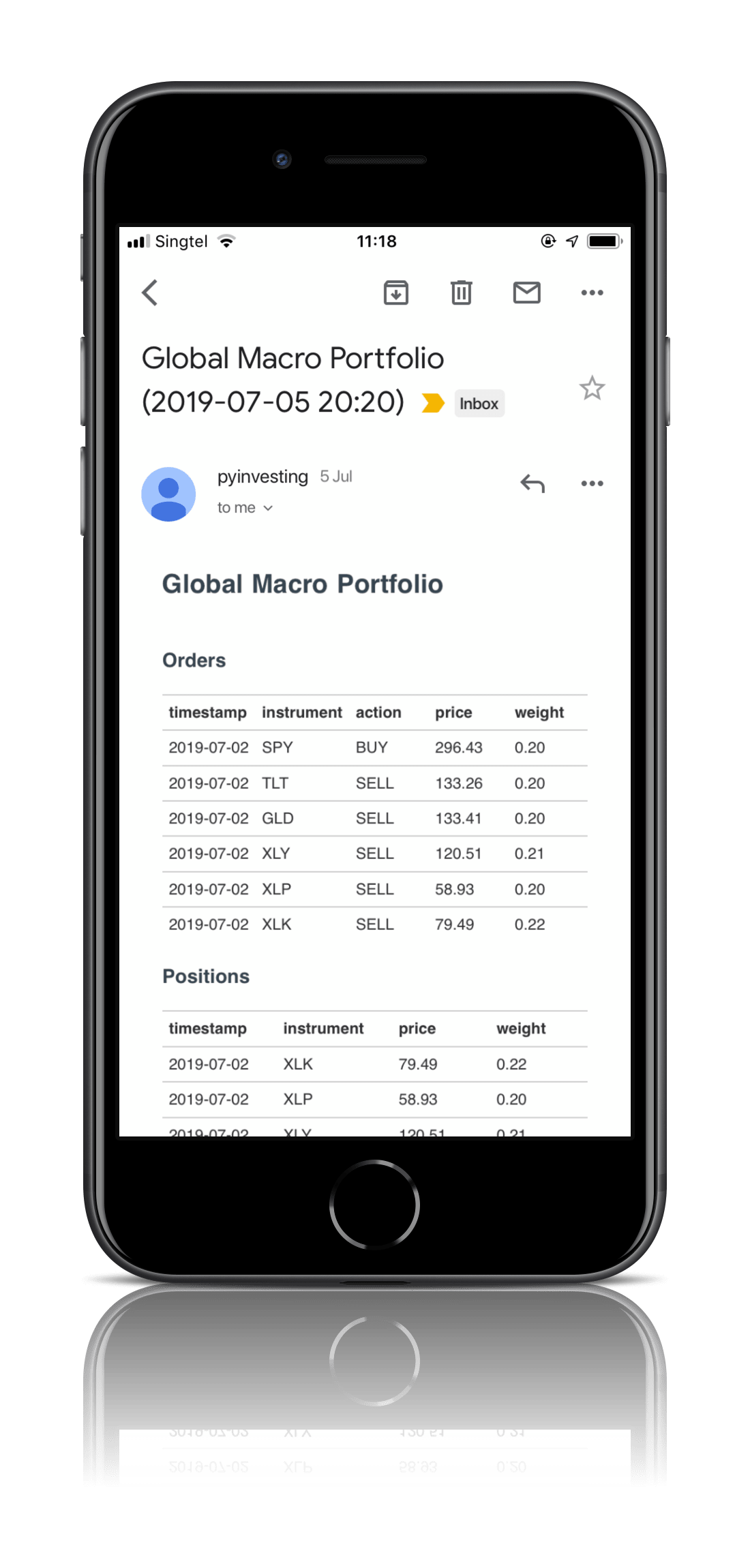

Every month, rebalance the portfolio so that 60% of the portfolio's weight is in the S&P 500 ETF (SPY) and 40% is in long term treasuries (TLT).

Rebalancing your portfolio to a strategic allocation of 60% stocks and 40% bonds works because it allows you to buy assets that have fallen in value and sell assets that have gone up in value on a regular basis.

For example, during a recession, as people flee from risky assets such as stocks into safe assets such as bonds, we can expect stock prices to fall and bond prices to go up. As a result, your portfolio's stock weightage will fall below 60% and your bond's weightage will increase above 40%. By rebalancing your portfolio back to a 60 - 40 mix, you are buying more stocks when they are cheap and selling bonds that are expensive during a recession. This increases the risk adjusted returns of your portfolio.

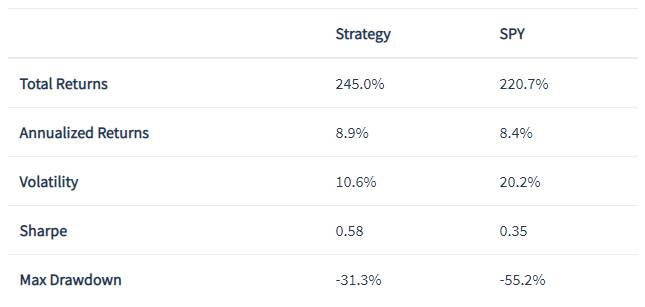

The backtest results show that the strategy significantly outperforms the S&P 500 with an annual return of 8.9% vs 8.4%. The strategy also does a great job in terms of risk management having a lower volatility of 10.6% vs the S&P 500 (20.2%). The strategy's max drawdown, which is the maximum capital loss from its peak is -31.3% during the 2008 financial crisis vs the S&P 500 which lost 55.2%.

© PyInvesting 2025