Ray Dalio All Weather Proxy

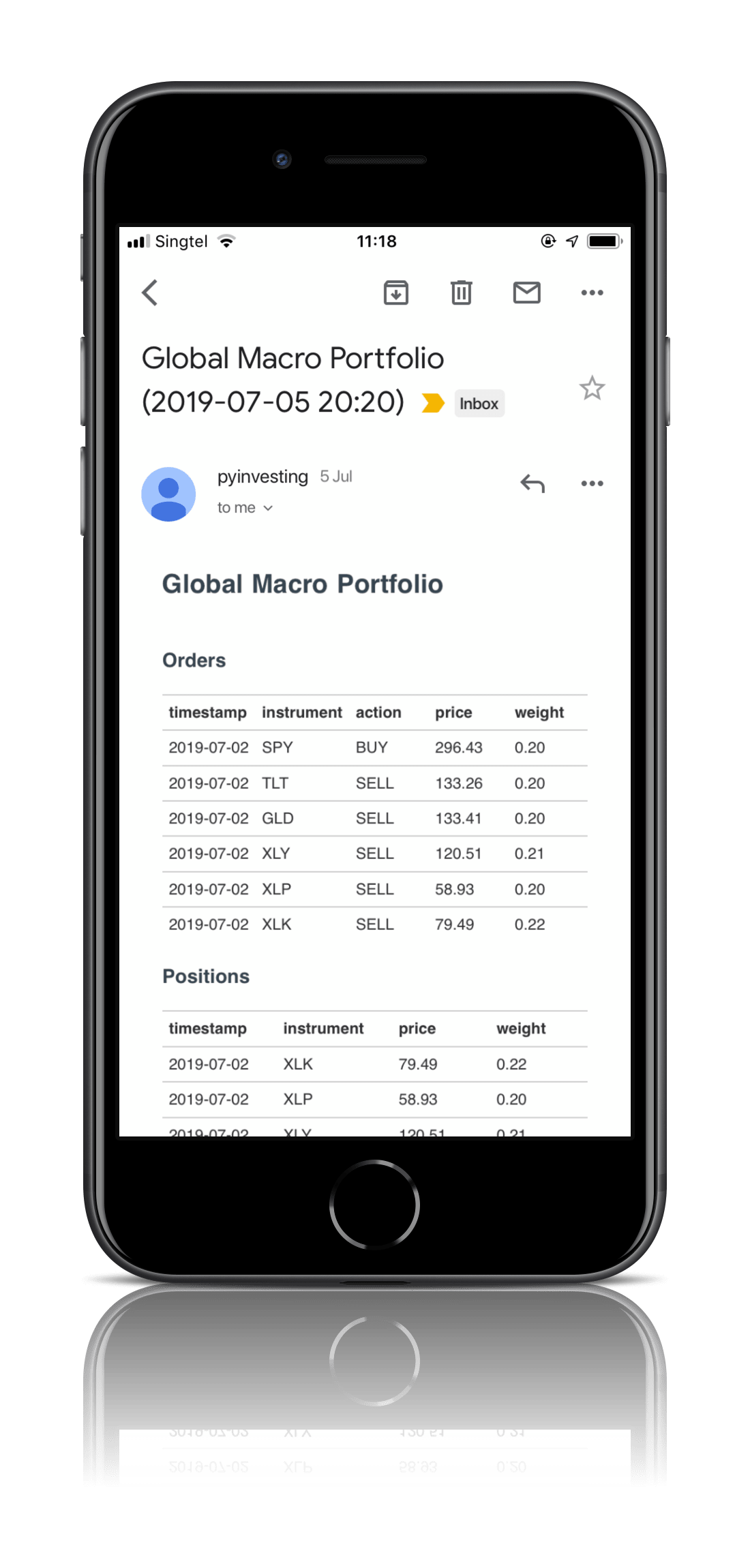

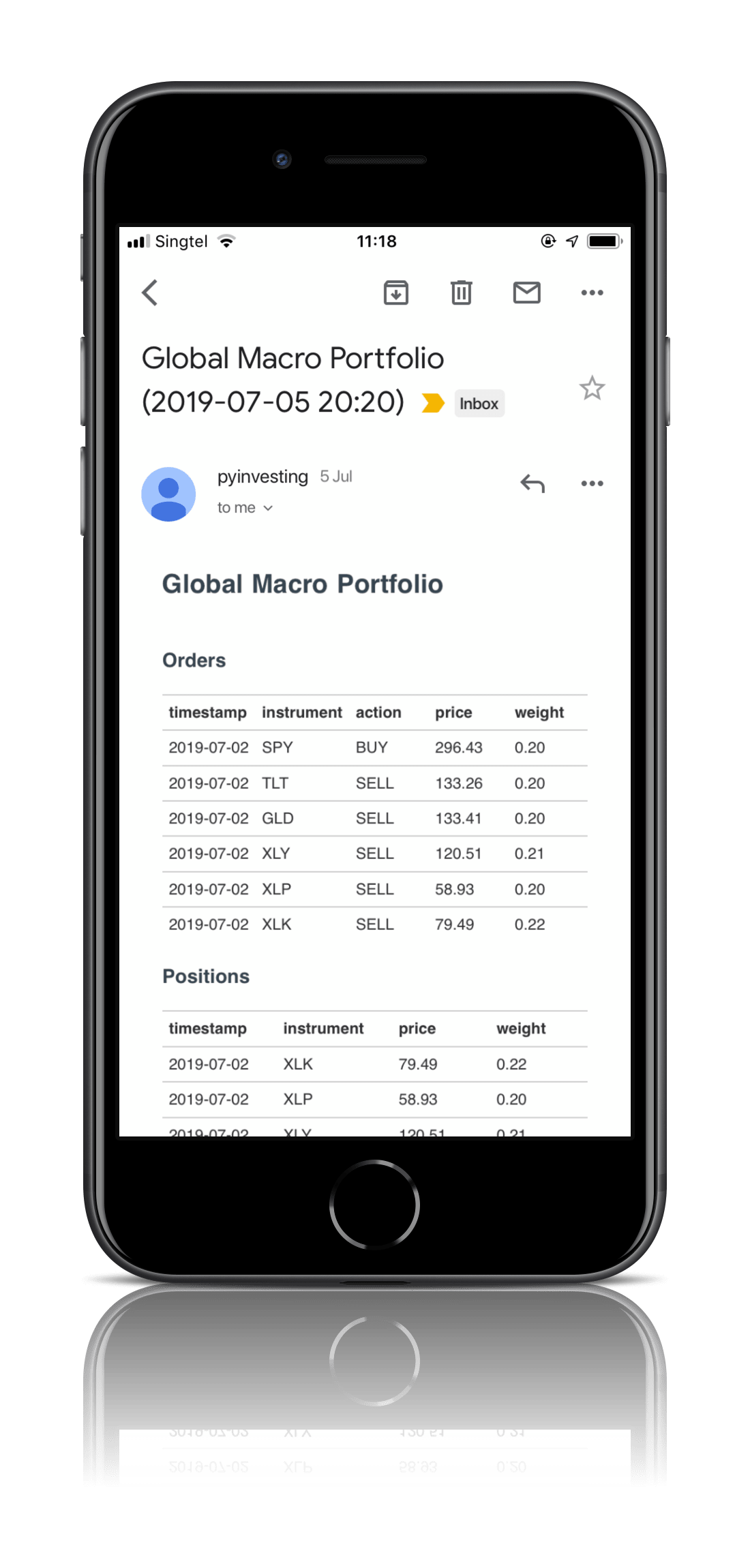

Every month, rebalance the portfolio such that 30% is in US large cap equities, 40% is in US long term treasuries, 15% is in US intermediate term treasuries, 8% is in commodities, and 7% is in gold.

This strategy uses asset class diversification based on different economic regimes and seasonality to reduce volatility and drawdowns. During recessionary regimes when asset classes such as gold and bonds significantly outperform stocks, the strategy will cash out on the outperformance from gold and bonds and reinvest the profits into stocks. This allows the strategy to take advantage of the lower stock prices during a crisis. Similarly, during a bull market where risky assets such as stocks outperform assets such as gold and bonds, the strategy will cash out some of the profits from stocks and reinvest them into gold and bonds at lower prices.

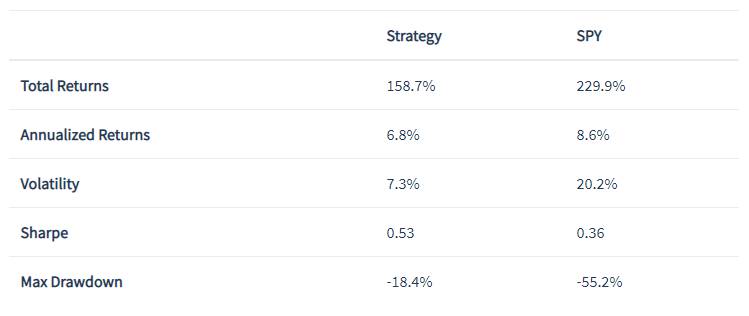

The backtest results show that the strategy has a annual return of 6.8% vs the S&P 500 which has an annual return of 8.6%. The strategy however has a much lower volatility of 7.3% vs the S&P 500 (20.2%). Consequently, the Sharpe ratio for the strategy is higher at 0.53 vs the S&P 500 which has a Sharpe of 0.36. The strategy's max drawdown, which is the maximum capital loss from its peak is -21.3% during the 2008 financial crisis vs the S&P 500 which lost 55.2%.

© PyInvesting 2026