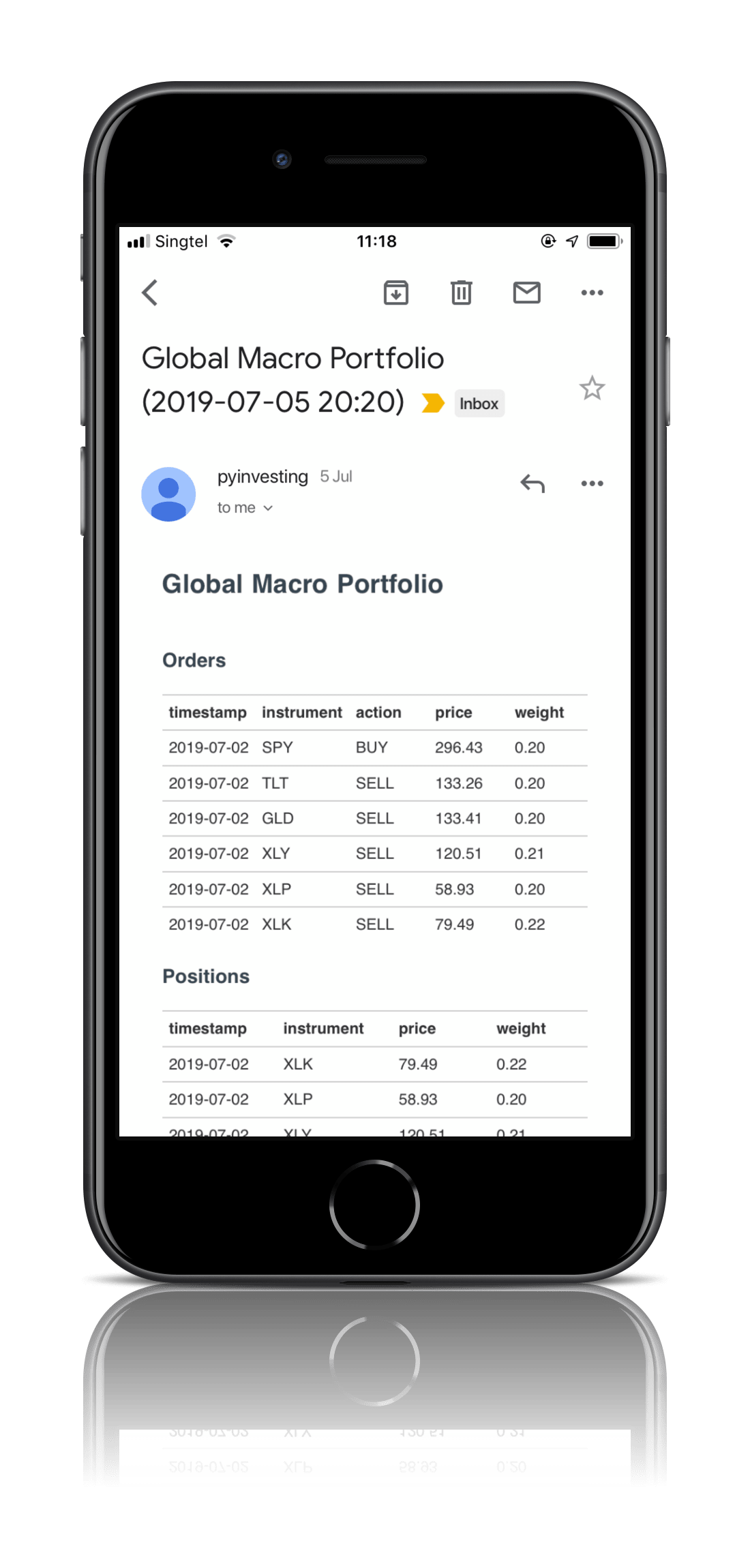

The investment universe consists of ETFs from 9 different sectors. Every week, select the top 3 ETFs with the highest 1 year returns and form an equally weighted portfolio.

Selecting sectors using a trend following strategy allows investors to take advantage of specific sectors that have strong momentum.

For example, during the recent oil crash, as energy stocks declined, the strategy avoided investing in the energy sector. In contrast, the strategy invested in the health care sector, where pharmaceutical stocks were trending. By tactically adjusting the portfolio to invest in trends across sectors, the strategy is able to improve risk adjusted returns vs a buy and hold strategy on the S&P 500.

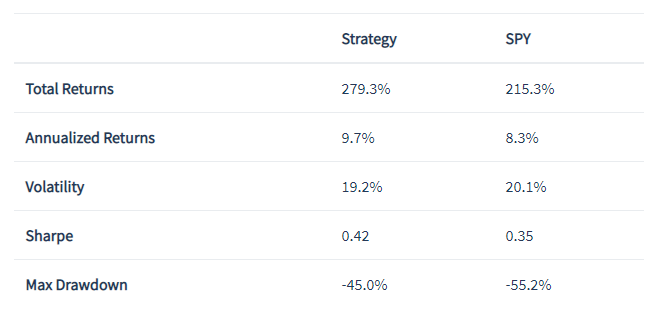

The backtest results show that the strategy outperforms the S&P 500 with an annual return of 9.7% vs 8.3%. The strategy also does a better job in terms of risk management having a lower volatility of 19.2% vs the S&P 500 (20.1%). The strategy's max drawdown, which is the maximum capital loss from its peak is -45% during the 2008 financial crisis vs the S&P 500 which lost 55.2%.

In this Covid-19 public health crisis, there are certain sectors such as consumer staples, health care and technology that are significantly outperforming the market. This makes sense as essential products such as food, beverages and household goods are still in demand. Pharmaceutical companies are poised for big gains as they develop drugs and vaccines to fight against the virus. Tech companies that allow people to work remotely from the cloud have also been able to thrive despite the social distancing measures.

Mebane Faber: Relative Strength Strategies for Investing

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1585517

© PyInvesting 2025