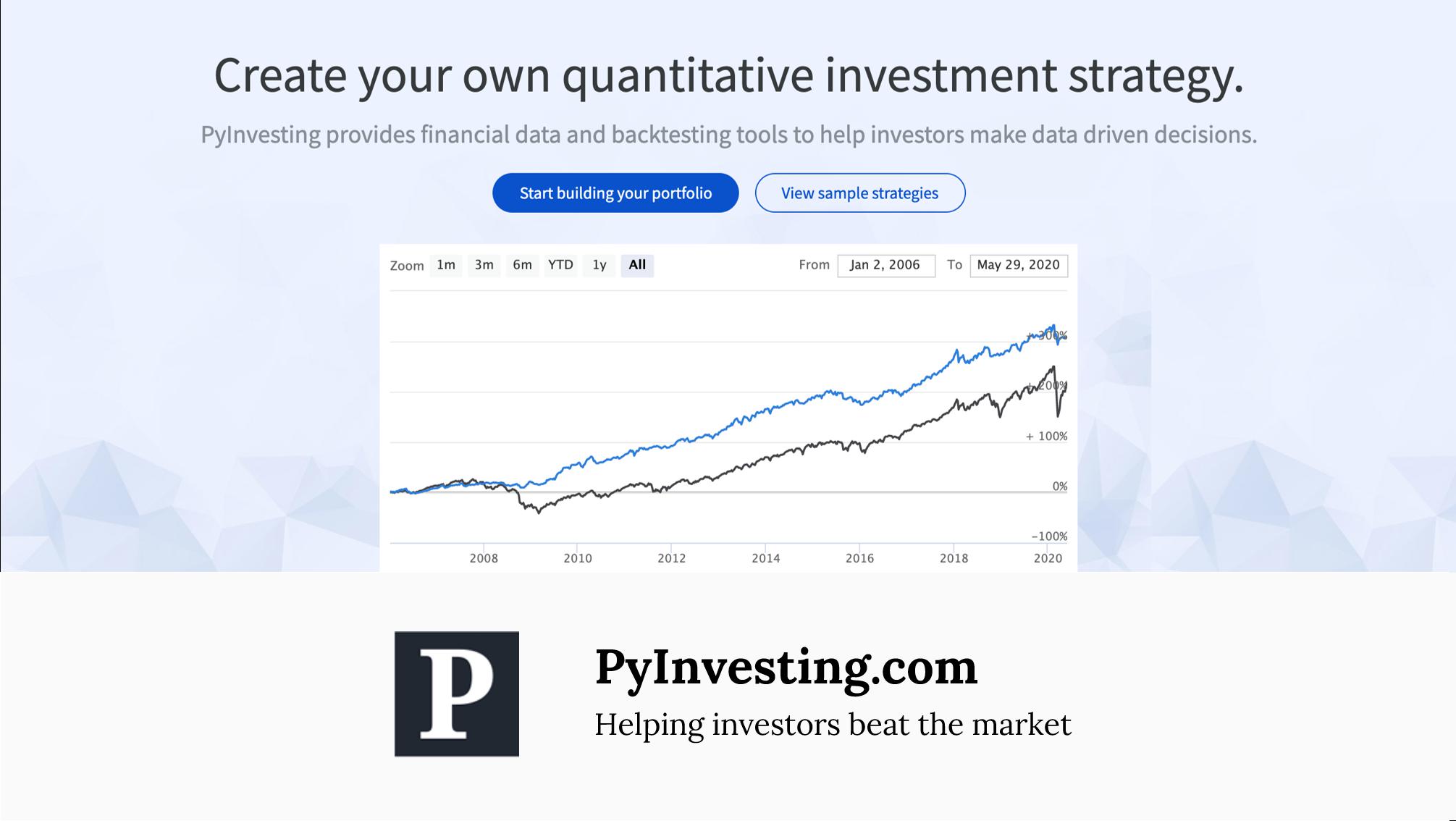

By now, you’ve probably heard of GameStop $GME, the hottest stock in the market right now. We know that many people are betting against $GME and shorting the stock. Don’t take it from us – Bloomberg reported that while Gamestop’s shares outstanding stands at 69.7 million, short interest is at 71.2 million shares. As part of preliminary fundamental analysis, let’s look into the business model of GameStop. And in terms of a Q3 2020 update, Gamestop’s net sales were $1,004.7 million, down 30.2% from the fiscal 2019 third quarter reflecting: The impact of operating during the last few months of the seven-year-long current generation console cycle and the subsequent limited availability of hardware and accessories; The unplanned shift of software titles later into the fourth fiscal quarter, and in some cases, into fiscal 2021; An 11% reduction in the store base, as part of the Company’s de-densification strategy, partially offset by recaptured sales through the transfer to neighboring locations and online However, did you know that this video game retailer hasn’t made a profit in two years? Considering Gamestop’s last annual report, Gamestop posted an operating loss of $399.6 million in FY ended 1st Feb 2020, and an operating loss of $702m in FY ended 1st Feb 2019. This is a stark shift compared to FY ended 1st Feb 2018, where they posted a net earnings of $439.2 million. As a physical retailer in a world where gamers download games online, the future of this business was not looking great. Gamestop’s CEO, George Sherman, addressed this point in their annual shareholder’s letter, stating the firm’s strategy as an omni-channel one with a ‘Buy Online Pick Up in Stores’ approach. However, considering the last two year’s financial performance, it remains to be seen if their shift from offline to online will pay off and turn the company’s finances around. Despite the gloomy outlook, the stock has surged over a whopping 1500% in January 2021 alone fueled by an army of rookie day traders from Reddit’s WallStreetBets forum. It first started with now famed Reddit User ‘Roaring Kitty’ (34 year old Keith Gill) who first posted a picture of his US$53,000 investment in Gamestop, reportedly an investment made in 2019 when Gamestop was at $5 a share. While that post alone did not attract much attention from the community aside from comments on lack of conviction in Gamestop’s share price rise, those comments spurred Keith Gill to continue to make more videos on popular social media channels such as Youtube and Tikok on Gamestop. This saw the start of the flood of retail money into Gamestop, with Keith Gill and Reddit user DeepF***ingValue being the first drivers spurring the community which collectively bought heavily shorted stocks such as GameStop. As we know, this eventually pushed share prices higher and squeezed out hedge funds like Melvin Capital and Citron, forcing them to close out their short positions in GameStop at a huge loss. The big question now is whether investors should continue chasing the stock or sit this one out on the sidelines. To answer this question, we looked at 3 technical indicators (Bollinger Band, MACD and RSI) to decide whether to participate in GameStop’s massive rally. #1 Bollinger Bands Bollinger Bands are the blue bands in the price chart below covering a standard deviation level above and below a simple moving average of the price. As the width of the bands reflect the standard deviation of the stock’s price, they become wider during periods when the stock is more volatile. At its current price of $325, GameStop is trading around 18% above its upper band implying that the stock is extremely overbought in the short term. As a result, the risk of a pull back in the short term is very high, making it a bad entry point for investors and traders. The middle band (yellow line) which is the simple moving average of the stock, is typically used as a support level. When the stock breaks below its support level, it indicates that the stock is no longer in an uptrend and would be a signal to sell the stock. If we assume a stop loss at this support level of $80 where traders will exit their positions, the risk of a GameStop trade is $80 / $325 - 1 = -75% which is extremely high. Given the high risk of this trade, investors would be better off finding other stocks with better trading setups and risk reward ratios. #2 MACD The MACD or Moving Average Convergence Divergence is a trend following momentum indicator that reflects the speed of a stock’s price. If it’s positive, the stock is trending upwards and if it’s negative, the stock is trending downwards. The larger the MACD’s value, the faster the speed. For those interested in the math behind the MACD, the indicator is calculated by subtracting the 26 day exponential moving average (EMA) from the 12 day EMA. GameStop’s MACD (blue line) has been taking off like a rocket since December last year. What this means from a technical standpoint is that the stock is accelerating where it is increasing its velocity over time. To the newbie investor, this could seem like a great opportunity. “Yes! Let’s get on this rocket as it takes off to the moon!”. But wait a second, let’s take a closer look at the MACD before the stock took off in December last year. Throughout the stock’s entire history since 2015, the MACD for GameStop has never come close to a value of 5. And in slightly over a month it shoots up to 57, implying the speed went up over 10X in a short period of time. This implies that the stock is extremely overheated in the short term and is unlikely to be able to sustain the same velocity going forward especially when WallStreetBets gets bored of GameStop and finds another stock to pump. #3 Relative Strength Index (RSI) The relative strength index (RSI) measures the magnitude of recent price changes to evaluate whether a stock is overbought or oversold. The RSI is displayed as an oscillator and can have a reading from 0 to 100. A stock is considered overbought when the RSI is above 70% and oversold when it is below 30%. GameStop’s RSI is currently at 83% implying that the stock is extremely overbought in the short term. As the stock is expensive based on the RSI indicator, investors would be better off waiting for the RSI to pull back to be able to get a better entry point. Conclusion Our 3 technical indicators show that GameStop is extremely overbought in the short term and buying the stock now is very risky with a potential downside of -75%. The prudent thing to do is to stay away from GameStop instead of chasing the stock at these insane price levels just because all the Redditors on WallStreetBets are talking about it. If you enjoyed this article and would like to create your own investment strategy on the cloud, I invite you to check out PyInvesting’s new beginners backtest where we will guide you through an example and help you understand how the website works. I hope that PyInvesting helps you in your journey towards financial freedom. Happy investing, and may the odds be in your favor. This joint post was done in collaboration with MissFITFI, a financial blogger who started her personal finance journey ten years ago, whilst building her career in the technology investments space.