Will value investing make you rich?

Warren Buffet, the 3rd richest person in the world with a net wealth of 86.3 billion, made his fortunes through value investing. Can we replicate his strategy to get similar results?

I ran a historical simulation of a value investing strategy and will be answering the following questions:

- What are the rules used to select value stocks?

- How profitable is the value investment strategy if we used it from 2006 until today?

What is value investing?

Value investing is an investment strategy that selects stocks which are cheap relative to their earnings. These stocks are undervalued relative to other stocks due to the market’s overreaction to bad news. This gives value investors the opportunity to take advantage of the low prices to make huge profits when the prices revert back to their fair value.

However, a value investment strategy is not without risks. A cheap stock can become cheaper if the company fails to improve, manage its cost and innovate. This is known as a value trap, which is every value investor’s nightmare.

Hence, value investors take on this risk for the chance to be rewarded with huge profits in the long run. Their investment horizons are usually at least 3 years and they will close their positions once the price is no longer attractive relative to its fair value.

How do we select value stocks?

From an investment universe of 500 stocks in the S&P 500, I select 50 stocks (top 10%) within the universe with the lowest price to earnings ratio (PE ratio). A low PE ratio implies that the stock is trading at a low price relative to its earnings which is an ideal candidate for value investors looking for cheap deals.

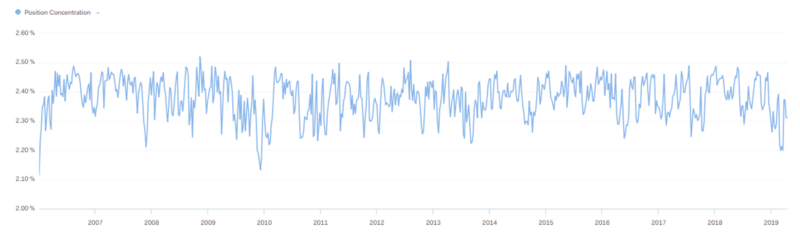

I equal weight each of the 50 stocks in the portfolio to reduce the concentration risk of the portfolio i.e. each stock in the portfolio has a target weight of 2%. The weights will deviate from 2% as the prices of stocks within the portfolio go up or down. If the weights deviate too far, the stock is re-balanced back to it’s target weight.

I’m not interested in how a single stock or a few stocks perform, but how the value investment theme performs. This means looking at a group of stocks (10% of the universe) with a low PE ratio and finding out if it outperforms the market as a whole.

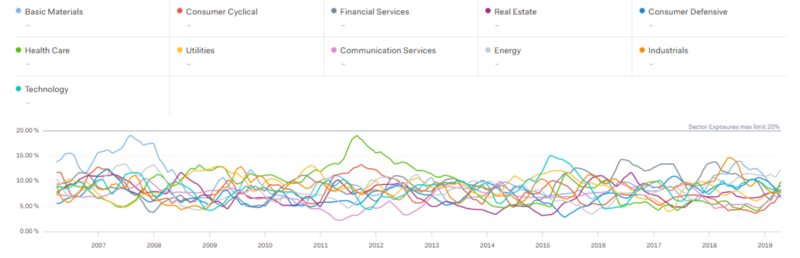

Another key aspect of the portfolio construction is sector neutrality. A stock that is cheap in the tech sector may be considered expensive to a stock in the utilities sector based on PE ratios. It does not make sense to compare the PE ratio of stocks between sectors because each sector has its own unique characteristics.

Hence we select the stocks with the lowest PE ratios within each sector to ensure that we do not end up with a bias towards sector that tend to have lower valuations. The plot below shows that the portfolio does not tilt towards any specific sector with every sector having a weight of under 20%.

Simulation Results

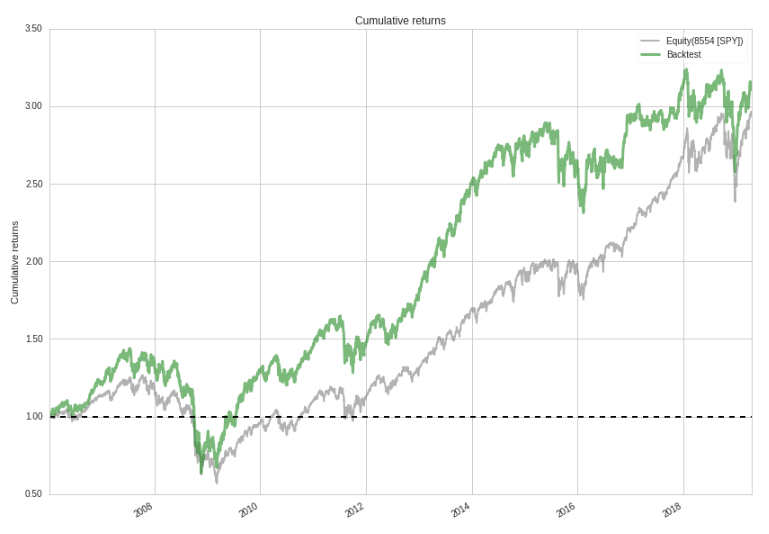

The simulation results show that the value investment strategy has an annual return of 8.9%. The strategy outperformed the S&P, making a cumulative return of 210%. While the strategy’s total returns are high, it’s comes with higher risk. It’s annual volatility is 19.7% vs the market’s historical volatility of 17%.

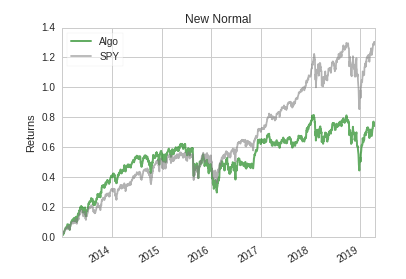

In addition, there are certain periods where the strategy performs worse than the market. If we compare the performance since 2013, the simulation shows that while the S&P makes 130%, the strategy only makes 80%. That’s a whopping 50% difference in performance. An investor that bought value stocks since 2013 will not be too happy!

Conclusion

Value investing has shown promising results overall, providing exceptional returns during certain periods in the past. Cheap stocks do have the tendency to outperform expensive stocks.

However, there are still risks involved where the investor might not be rewarded for taking on the value risk premium, such as the period from 2013 onward.

This goes to show why most successful value investors have a long investment horizon from 3 years onward. This gives them ample time to ride out periods of under-performance for the chance of making huge profits in the long run.

Find out what Datascience Investor has to say about value investing:

https://www.datascienceinvestor.com/post/is-value-investing-still-relevant-or-is-it-dead