Choosing high quality value stocks that outperform

When it comes to investing, everyone loves to talk about glamorous stocks such as the FAANG stocks (Facebook, Apple, Amazon, Netflix, Google). These are the stocks that get a lot of attention from investors and make good conversation topics at parties. However, is now the best time to be holding these stocks?

Probably not, if you are a believer in value investing as these highly popular stocks are pretty expensive relative to their earnings.

In my previous article, I wrote about how the value investment theme of selecting cheap stocks outperforms expensive stocks. While I was explaining the question of why value stocks outperform over time, we also discussed how value investing is subjected to risks such as the value trap, where cheap stocks continue to remain cheap because the company fails to improve and innovate. This implies that value investing doesn't work all the time and there is certainly room for improving the strategy.

Can we do better in selecting value stocks that outperform stocks in general?

In this article, I investigate how we can improve our value investing strategy by filtering for high quality stocks. By selecting stocks that are both cheap and are highly profitable, it is possible to increase the performance of our strategy. The best part about this strategy is that it is completely rules based so there is no room for opinions and speculation. Everything is straight forward based on the valuation and profitability numbers. By using a systematic value investing strategy, we are able to remove emotions and completely rely on logic to make our investment decisions.

How do we select quality value stocks?

From an investment universe of 500 stocks, I select 50 stocks with the lowest price to earnings ratio (PE ratio) and the highest return on equity (ROE).

The PE ratio is a stock’s adjusted close price divided by its earnings per share (EPS). A low PE ratio implies that the stock is trading at a low price relative to its earnings. A cheap stock has a low PE ratio.

The company’s ROE is its net income divided by its average total common equity. It is a measure of how much profit a company can generate with every dollar of capital. A high ROE implies that a company is highly efficient because it is able to generate profit with relatively little capital. A quality stock has a high ROE.

To select the stocks, I rank each stock in the universe based on their inverse PE ratio (since we want stocks with a low PE ratio to have a high ranking) and ROE. Next, I take the average of each stock’s PE ratio ranking and ROE ranking. This gives me an overall signal which combines both value and quality factors and allows me to select low price high quality stocks.

Risk management

I equal weight each of the 50 stocks in the portfolio to reduce the concentration risk of the portfolio. This will prevent my portfolio from taking a big hit if any single stock crashes.

In addition, stocks with the strongest signal within each sector are selected such that no single sector has a weight larger than 20% of the portfolio. This reduces sector risk and allows us to isolate the source of outperformance due to the value and quality signal.

I do not want the strategy to outperform or underperform because it was overly exposed to a single sector but rather because the strategy was invested in cheap and high quality stocks across all sectors.

Performance

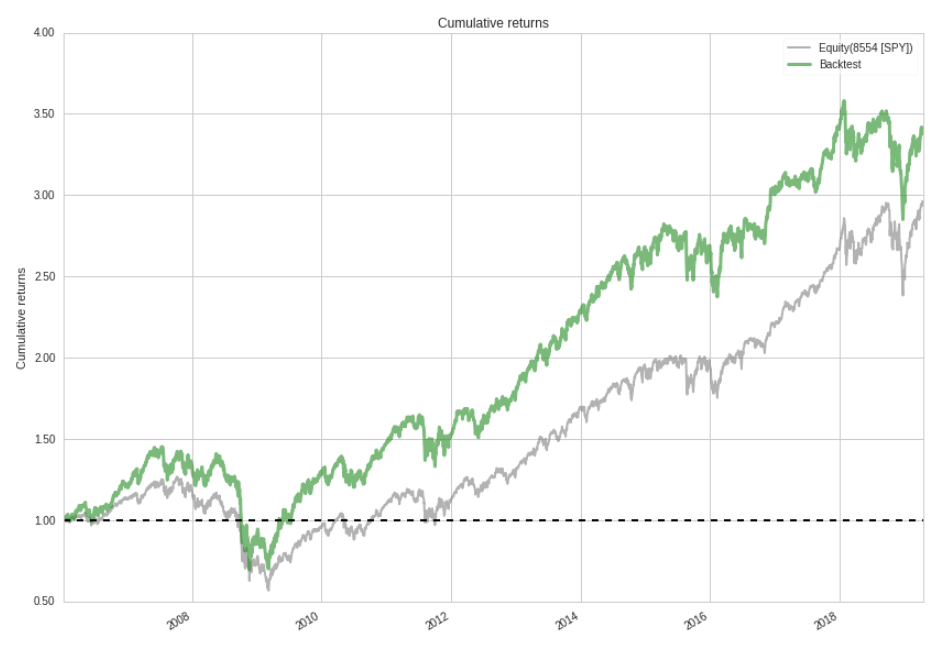

I used Quantopian to backtest this python value investing strategy. The backtest results show that the quality value strategy has a cumulative return of 238%, outperforming the S&P 500 benchmark by almost 50% since 2006.

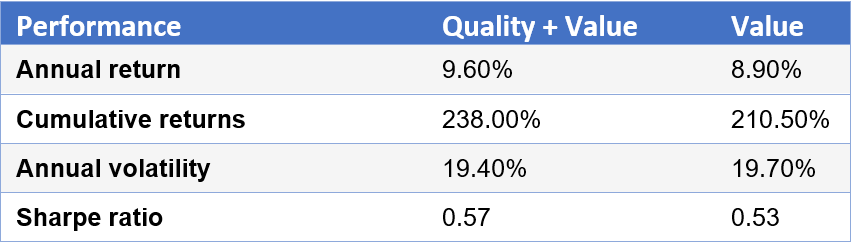

More importantly, by including the quality factor to our pure value investing signal, the performance of our strategy has improved! The quality value strategy makes an annual return of 9.6% vs the pure value strategy which makes 8.9%.

Besides increasing the returns of the strategy, the quality value strategy has a lower volatility of 19.4% vs the pure value strategy’s volatility of 19.7%. This means that the risk of the strategy has decreased.

As a result, by combining the quality factor to our value factor, the risk adjusted returns of the strategy has increased. Hence for the same level of risk, the quality value strategy makes a higher return. This is reflected by the higher Sharpe ratio of the quality value strategy 0.57 vs 0.53 of the pure value strategy.

Conclusion

By combining the quality factor with our initial value investing strategy, our backtest has shown that we are able to achieve higher risk adjusted returns. This is because the stocks from our quality value strategy are both cheap and highly profitable. This strategy appeals to value fundamental investors that have a long investment horizon.

While Warren Buffet once said that it’s better to buy a wonderful company at a fair price than a fair company at a wonderful price, I would argue that it’s even better to buy a wonderful company at a wonderful price.