GSV · Gold Standard Ventures Corp

-

-

1 Comment

Gold Standard Ventures Corp is currently in a long term downtrend where the price is trading 17.5% below its 200 day moving average.

From a valuation standpoint, the stock is 100.0% cheaper than other stocks from the Basic Materials sector with a price to sales ratio of 0.0.

Gold Standard Ventures Corp's total revenue sank by nan% to $0 since the same quarter in the previous year.

Its net income has dropped by 97.7% to $-5M since the same quarter in the previous year.

Finally, its free cash flow fell by 55.5% to $-12M since the same quarter in the previous year.

Based on the above factors, Gold Standard Ventures Corp gets an overall score of 1/5.

| Sector | Materials |

|---|---|

| Exchange | NYSE MKT |

| CurrencyCode | USD |

| Industry | Metals & Mining |

| ISIN | CA3807381049 |

| Target Price | 0.95 |

|---|---|

| Dividend Yield | 0.0% |

| Market Cap | 156M |

| PE Ratio | None |

| Beta | 0.94 |

Gold Standard Ventures Corp

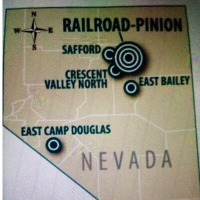

Gold Standard Ventures Corp., an exploration stage company, engages in the development of district-scale and other gold-bearing mineral resource properties in Nevada, the United States. Its flagship property is the Railroad-Pinion project covering an area of approximately 53,570 acres located in the Elko County, Nevada. The company was incorporated in 2004 and is headquartered in Vancouver, Canada. As of August 12, 2022, Gold Standard Ventures Corp operates as a subsidiary of Orla Mining Ltd.

Learn More